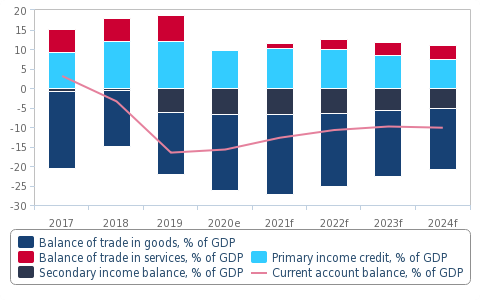

A recent comprehensive report by Fitch Solutions on the Mauritius economy forecasts that the current account deficit will narrow to 12.8% of GDP in 2022, as tourism receipts continue to strengthen and oil prices decline at international level.

According to the finance minister, Mauritian export competitiveness will also be supported by a 50.0% reduction in port dues and terminal handling charges (extended until 2023) and the Freight Rebate Scheme, which includes a 60.0% refund on air freight costs for certain exports (extended until June 2022).

It is thus expected that Mauritian merchandise exports will rise by over 37.0% in USD terms this year, compared to 2020. We anticipate strong demand for Mauritian export goods such as caviar, fish and clothing due to strong growth in key export partners including South Africa (4.0%) and France (5.9%). Prices will also help. Our Commodities team forecast that the price of sugar (which accounts for 12.1% of merchandise exports) will rise from USc12.9/lb in 2020 to over USc16.5/lb in 2022.

However, imports will keep the trade balance in deficit. Forecasts tend to demonstrate that demand for imported goods will decrease this year. While it is forecasted that the currency will depreciate further, from MUR39.35/USD at the end of 2020 to MUR42.90/USD at the end of 2022 – the government is using price controls and subsidies for importers to prop up demand for imported goods. Fitch Solutions expect that merchandise imports growth will drop to 15%.

Based on statistics from Statistics Mauritius and analysis related thereto by Fitch Solutions, it is expected that Mauritius’ current account deficit will narrow further to 12.8% in 2022. It is further anticipated that export growth will slow to 23.1% y-o-y in USD terms. That said, falling oil prices – we forecast a 4.3% fall to USD67.0/bbl in 2022 – will also cause import growth slow to 15.0%, leading to an overall narrowing of the current account deficit. On the services side, it is expected that an improved Covid-19 situation in Mauritius and the loosening of restrictions on tourists will result in even stronger tourist receipts this year.

Mauritius is expected to continue to attract financial and capital inflows to cover its deficit. However, even if these inflows were insufficient, Mauritius has recently been allocated USD195.0mn worth of new Special Drawing Rights from the IMF – more than enough to cover any temporary balance of payments needs.